If I told you what your bank balance was going to be in 7 months time. Would you be able to tell me if I was wrong? Are you always a little surprised by payments to the ATO, or super?

Do you know the months you need to save cash, and the months you’re going to need it?

Do you know how much of every dollar of sales you make, you need to put aside for GST, income tax, super, PAYG Withholding?

If you answered yes to all of those, GOLD STAR for you! You can take the rest of the day off.

If you answered No to any of those questions, then this blog is for you. Hopefully it will open your eyes to the power and true intention of a forecast and why your business needs one.

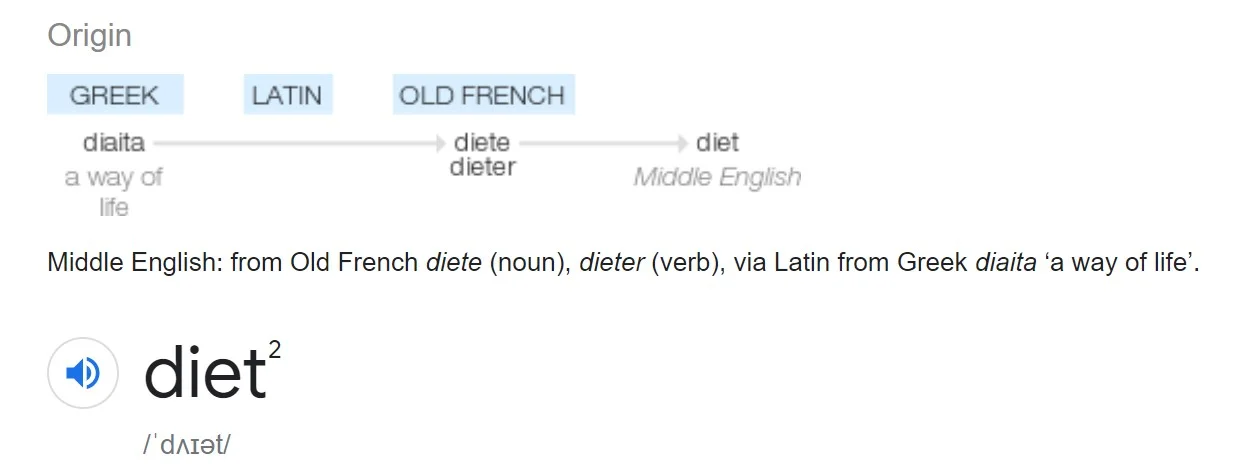

You’ll notice I use the word forecast and not budget. This is for a couple of reasons; think of forecast as an “eating plan”, and budget as a “diet”. They are in fact one and the same (don’t believe me? Check out the origin of the word “diet” …from the Greek “diaita” meaning “way of life”)

Source: The Big Google

But if you say budget, you sound like a boring accountant and it’s going to be restrictive and painful and immediately you all put up defenses and don’t want to do it, right?

And just like a diet, you won’t last long until you’re wondering if calories still count if you don’t put them in MyFitness Pal.

But forecast. Forecast sounds like you’re predicting the future, like telling you what you’ll look like when you’re 10% body fat, and that is useful when it comes to motivating you, and planning your cash and business operations.

Now you’ll be familiar with a budget.

That’s where you say, I can only afford to spend $X on this and $Y on that, and left over each pay will be $O. It confines you to those amounts otherwise you’ll fall off track.

But a forecast isn’t designed to stop you spending or doing anything, it’s designed to tell you what the outcomes of your choices are. It will tell you based on the assumptions and information you give it what your profit, cash and tax will be at any given point in time.

Wondering when you next need to hire someone? Or if you can afford to get that new piece of machinery? Or what your profit would be if you increased your prices by 5%?

That is the power of a forecast. It gives you the information to make informed decisions, rather than gutfeel (aka guessing).

Related Content

Now the traditional method business’ use for forecasting is to increase expenses by 3% and sales by 10%. There, forecast done for another year. Wonderful.

Except they have no bloody idea how they are going to get those increased sales. Where’s the marketing strategy? Where are you going to find your leads? What activities do you need to do each day to get those leads? What’s your conversion rate? How long does it take to convert those leads to a customer to cash? What mix of products/services do you sell? What’s the average sale per customer? How often do customers buy?

If we want sales growth of 10%, what changes in marketing spend are going to be made? What’s the return you’re expecting on that spend? Where are you going to spend it? How long between spending it and getting the sale is it? That’s what a forecast is for.

It should make you think about how you will achieve the sales amounts you’re entering. Hoping this year’s sales are the same as last years or “a bit better” is a terrible strategy. Hope has never been a strategy, so stop hoping and start doing.

If the ending cash balance is negative or low, the idea is not to fiddle with the amounts to make it positive.

These are the times you need support from your bank or other financier. If everything else in the forecast is as you say it is, that you’re funding growth, or seasonality puts strain on your cash flow, but overall the business is in sound shape and will come back to positive cash, then that’s the perfect time to say hello to us so we can help get you some business finance and help you through those periods.

You May Also Like

Now accountants have been flogging budgets and forecasts for years, but the key to it is to create one that best fits your needs. We believe there are 3 types of forecasts: 1) Back of the envelope, 2) Basic and 3) Three-Way Forecast.

What’s the difference and which one should you do?

Back of the envelope

Suits a simple business, with predictable expenses and limited seasonality. Usually used for annual profit and income tax forecasting.

Basic

A bit more sophisticated, breaks it down to monthly figures, and provides the profit, income tax, GST and cash balances each month.

Three-Way forecast

Gold plated Rolls Royce Phantom.

Provides a forecast of the 3 financial statements being profit & loss, balance sheet and cash flow statement. Usually done by month, but can be done for week or day (depending on how big the business is) it’s best used for more complex businesses with multiple departments or product offerings, customers and suppliers on trade credit, those with inventory purchases or those with funding covenants.

This type of forecast allows you to really scenario plan and compare differing strategies and the financial (cash impact) of each to allow you to make a decision of which to pursue. The banks usually request these if you’re applying for a decent size loan.

Luckily for you and us, we’ve moved on from pen and paper models and there’s software that does most of the heavy lifting these days. Having said that, a pen and paper forecast is better than no forecast, so if you do anything, do that.

But if you want to get more rigour in your forecast and have a bit of comfort that you’re doing it right, check out our business consulting services and how we can provide the smarts for you.

Now get onto it, a new financial year is just around the corner. Make this the year you can see what’s coming.