– Algamish

Business cash flow can be tricky. Especially when you’re starting out. You see money come into the bank account, you start thinking what you can do with that. Then there’s wages to pay, suppliers you owe, your accountant has reminded you that super and BAS are due, and you need put money away for income tax for next year. Seems like everyone gets paid before you.

That money that just landed in your account goes out just as it comes in. Like the tide. And you start wondering;

How much of that cash is mine to keep?

And this is how a lot of business owner’s get themselves in the poo.

They spend the money in the bank without an awareness of all the other things they need to pay. Their mental tally of who they owe is a bit lacking, and/or they think the tax bills can be paid with what old mate owes them on that invoice they just issued.

They see each dollar that comes into the bank account as theirs and this just can’t be. “Spend money to make money” is never truer than in business.

Related Content

If your accountant is on the ball, they’ll tell you to transfer certain percentages each week/day/month to a savings account to help with this. If you were fancy, you’d call this the “treasury function”.

Then you’ll have the cash when the bills come in – and don’t get me wrong, that’s all true and I tell my clients the same thing and there have even been entire books written on the subject.

But you’re not a maths whiz how do you work out these percentages?

GST is 10%, or is that 1/11th?

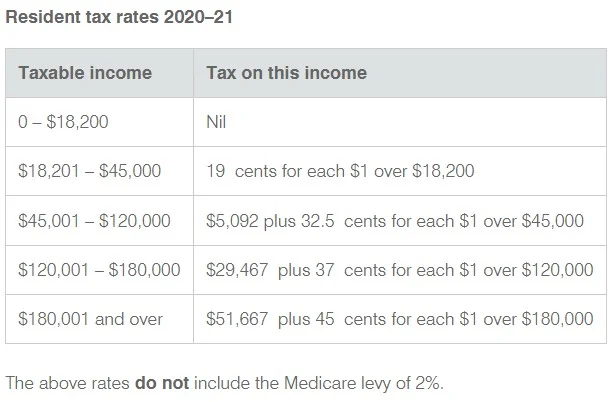

Income tax in a small business company is 26%

Your gross margin is apparently 60% (or so your accountant told you)

Your overheads are 20%, superannuation will be 10%… to many numbers. It’s all too hard. I get it. The answers can even surprise me.

Even if you’re on top of your financial profile you can be off due to the impacts of GST and other liabilities. Just check this out;

|

|

Ex GST (Like Your P&L) |

% of Sales |

|---|---|---|

|

Sales |

$1,000,000 |

100% |

|

Cost of Goods Sold |

$400,000 |

40% |

|

Gross Profit |

$600,000 |

60% |

|

Wages |

$250,000 |

25% |

|

Superannuation |

$25,000 |

2.50% |

|

Other |

$125,000 |

12.50% |

|

Total Overheads |

$400,000 |

40% |

|

Net |

$200,000 |

20% |

|

Income Tax |

$52,000 |

5.20% |

|

Net Profit after Income Tax |

$148,000 |

14.80% |

|

Less GST |

$0 |

0% |

|

Remaining |

$148,000 |

14.80% |

If you just use your P&L numbers you would think that ~ 14.80% of what comes in is yours. But not so.

Watch what happens when you factor in GST.

|

|

Inc GST (Like Your Cash Flow) |

% of Sales |

|---|---|---|

|

Sales |

$1,100,000 |

100% |

|

Cost of Goods Sold |

$440,000 |

40% |

|

Gross Profit |

$660,000 |

60% |

|

Wages |

$250,000 |

23% |

|

Superannuation |

$25,000 |

2% |

|

Other |

$137,500 |

13% |

|

Total Overheads |

$412,500 |

38% |

|

Net |

$247,500 |

23% |

|

Income Tax |

$52,000 |

5.20% |

|

Net Profit after Income Tax |

$195,500 |

18% |

|

Less GST |

$47,500 |

4% |

|

Remaining |

$148,000 |

13.45% |

Even though the absolute dollar amount is the same ($148,000), the percentage drops to ~13.5%.

So what? you might say, 1.3% isn’t much. It’s close enough.

But that’s all relative to your turnover.

On $1.1mil of sales inc GST, 1.3% is $14,300.

On $2.2mil, it’s $28,600.

You see where this is going?

You May Also Like

But that’s not all folks.

It’s not just semantics around GST, it’s also loan repayments.

Because out of that net profit after tax amount comes the balance sheet items like the principal component of your loan repayments (e.g cars, machinery, fitout loans) and ATO payment plans.

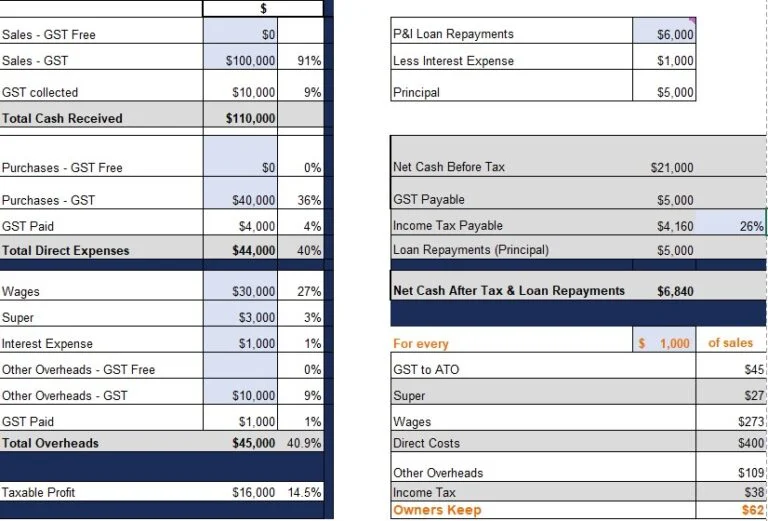

As you might appreciate, this can get super complicated super quick. And that’s the benefit of a cash flow forecast so you can see the month-to-month ebbs and flows to take into account the timing of BAS and superannuation payments. But for a quick and dirty average for the whole year try this little tool we whipped up.

Just enter the numbers from your financial statements, and away you go. Now you know how much cash is left to pay dividends, make extra repayments towards debt, buy assets, or give yourself a pay rise.

Now before you go transferring this amount to your offset account, remember there’s only 4 ways to get cash out of a company, and that any cash you draw from the business is going to incur tax at your marginal tax rate. Not the company tax rate. So you need to factor that in.

Individual tax rates quickly outpace the company tax rate, so if you do want to take this additional cash, then it might be best to just increase your salary.

If you want to take dividends and distribute that through the family trust to a beneficiary on a lower tax bracket, make sure you understand how taxes on dividends work and how much cash from that dividend will need to be saved to pay the tax on that dividend.

Clearly this can get complex, and you’ve got no desire to be an accountant, so that’s why you outsource this stuff to them. So if you’re not getting the answers you need and want a hand getting on the front foot with your taxes, check out our accounting and tax services.