Every business should strive to better understand their financial performance so that they can continuously improve it. The one that everyone loves to look at is the Income Statement, better known as a Profit and Loss Statement (P&L) but other than a surface understanding, this financial report remains mysterious to many business owners on how it can be used to improve your business.

If you find yourself in that position, that’s okay. Here’s what you need to know to better understand how your business is doing financially.

An Income Statement is a type of financial statement that looks to quickly summarize a business’ revenues, and expenses over a specific period. Typically, the term Income Statement is used when we are reporting information to regulators like ASX, but in general it is the same as a profit and loss statement. As most people are more familiar with “profit and loss” we’ll use that term interchangeably in this blog.

As a management tool a Profit & Loss Statement is compiled for a month, quarter or year, but you could compile one using data from a shorter, like a day or a week.

The Profit & Loss is sometimes also called a statement of financial performance, a statement of income, a statement of operations, an earnings statement, or an expense statement. When you hear the term “P&L management,” that refers to how a company is handling its P&L Statement using cost and revenue management strategies.

A P&L Statement generally contains the following:

- Information about revenue or sales

- The cost of sales or cost of goods sold (direct costs)

- Expenses related to selling, general, and administrative costs (overheads)

- Marketing and advertising costs

- Costs associated with technology

- Interest expense

- Tax liabilities for the period

- The net income of the business

All of that in mind, the basic formula that a P&L Statement follows is;

revenue – expenses = profits.

The hope is that your business will end up with a positive number; a profit, rather than a negative number; a loss.

With that said, losing money isn’t uncommon, especially for businesses during their first few months or years of operation. Still, to be a sustainable business your business needs to see a positive (upward) trend, meaning that you are profiting more and more each time you generate a new P&L Statement.

You already know that a P&L Statement will show you your total revenue and your total expenses along with whether your business was profitable during a specific time period. But, what else can a P&L Statement show you? At the end of the day, a P&L Statement goes beyond a tool for accounting and working out your taxes.

A P&L is fundamental in working out your break-even point (how many sales do we need just to cover our costs), and in scenario planning (if we increase price by x% what would that do to our sales, if we discount our price on this product what would that do?)

It is so important it shows you the viability of your entire business model and it offers a lot of crucial data for cutting costs and increasing revenue in the long-term.

Revenue

Your revenue in the P&L Statement represents the total turnover or net sales for the given period. It should include the revenue you earned from primary business activity alongside non-operating revenue and gains, like those relating to the sale of business assets.

Cost of Goods Sold

This represents the total cost associated with the products and services you use to serve customers, like the cost of acquiring inventory for the given period.

Gross Profit

You may also hear this called your “gross margin” or “gross income.” Your gross profit is your net revenue excluding the cost of sales.

Operating Expenses

These are your administrative, selling, and general expenses that relate to running your business during the given time period. Examples include rent, payroll, utilities, and other things you had to pay to operate. You should also include non-cash expenses, like depreciation.

Operating Income

This refers to your earnings before depreciation, interest, taxes, and so on. You should deduct your operating expenses from your gross profit and this allows you to calculate your operating income quickly.

Net Profit

This is the total amount you earn after deducting all expenses. Just subtract your total expenses from your gross profit to get your net profit.

Confused? It’s actually quite easy to make all of these calculations. Here’s a summary:

- Your gross profit is your sales minus the cost of sales (direct costs).

- Your net operating profit is the gross profit minus operating expenses.

- Your net profit before taxes is your net operating profit plus other income (like interest on your savings accounts) minus other expenses.

- Your net profit or net loss is your net profit before taxes minus your income taxes.

As you can see, none of these are terribly difficult concepts to grasp, and your accounting software like Xero.com will do it for you – but the important part is ensuring the transactions are coded to the correct account and that the formatting of the profit and loss provides meaningful data.

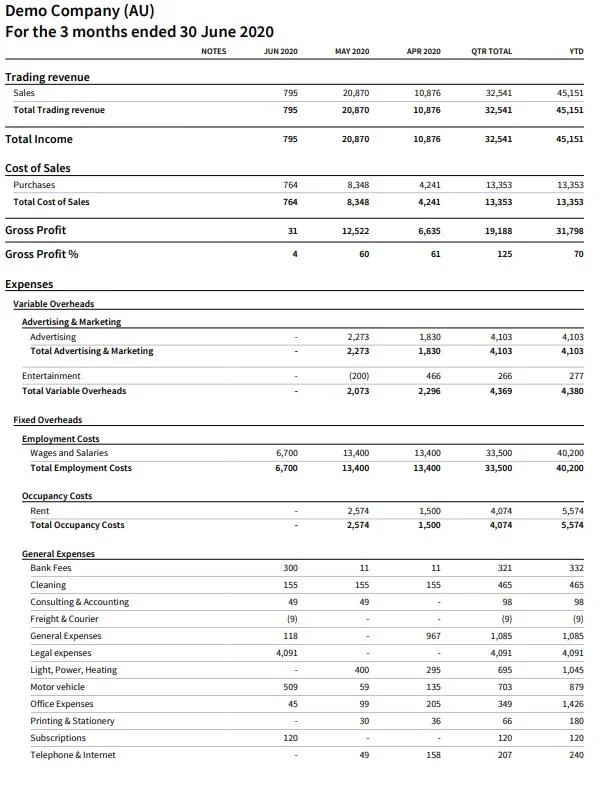

Having your expenses listed in alphabetical order is nice to be able to find things, but it provides very little insight into your business. Instead your income and expenses should be grouped by function, like this;

What most people do with a profit and loss statement is go straight to the net profit number, and while it’s nice to see a big healthy number there, the real importance for the future of your business is how that number was created.

What income and expenses contributed to it or reduced it? By how much? Is that profit big enough for the sales we generate? What percentage of sales are being used by overheads like wages and rent? How much mark up are we achieving on our inventory?

With all of this in mind, it may sound like a P&L Statement required an awful amount of work, but that’s truly not the case at all. So long as you have a good bookkeeper recording transactions to the right accounts, you should have no issue in getting really valuable information from your profit and loss

Beyond that, once your P&L Statement is all ready to be reviewed, you’ll find that regularly generating these statements will prove extremely valuable to your business. After all, these statements play a critical role in many aspects of your operations and growth.

Now as we’ve discussed your P&L Statement is important and is critical in working out if you are making profit on your operations, but another critical question is – what did that profit go? What did we spend it on? That’s where the balance sheet comes in.

So combining these reports together on a regular basis, critically analyzing them and discussing them with your small business board of advice is what will stop you flying blind and help you make informed decisions for your business.

At the end of the day, taking the time to understand your P&L will prove absolutely worth the work you put in. Creating a system that makes it almost completely effortless to do so whilst ensuring the reliability and accuracy of the numbers is something that every small business should be doing.

If you’re having trouble understanding your numbers, check out our accounting and tax or business consulting services to see how we can help. It can literally make you thousands of dollars.