It’s not how much you make it’s how much you keep – right?

In your personal life this is represented by the amount you’ve saved, and the value of investments less debts. You can tell if you’re making progress by comparing this to a prior period, like last year. And this is no different for a business.

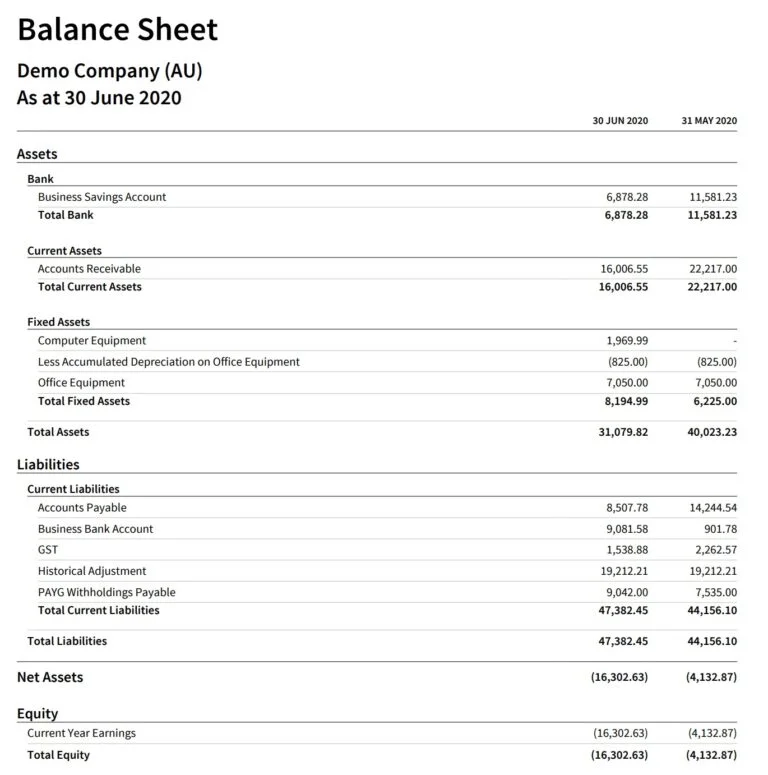

Where the profit and loss statement tells us how much profit you made, the balance sheet tells you where you “spent” that profit. Did you increase the amount of cash? Did you buy more equipment, or more stock? Do customers owe you more than last period? Did you pay down debt?

These are the things a balance sheet tells us. It’s an important financial tool that provides an overview of company liabilities, and assets. This report along with a few other statements are used to evaluate the financial health of a business. Here, we will explain exactly what a balance sheet is, the purpose it serves, and how it can benefit your business.

Also known as a “statement of financial position,” the balance sheet is used by business owners, investors, and analysts, in conjunction with the cash flow and profit and loss (income) statements to assess a company’s profits, obligations, and overall success.

It tells you how much a business is worth at a specific date – a snapshot of the business in a moment in time- and is best used when compared to a previous period – like last year or last quarter. These comparisons enable you to track performance and growth, as well as identify areas that need improvement.

Balance sheets form part of the financial statements your accountant will give you at the end of the year, and form part of our accounting & tax services.

But you shouldn’t be waiting until your accountant prepares them at year end – you should be looking at your balance sheet monthly, and at the very least quarterly when doing your BAS.

Your balance sheet will give you critical insight into its ability to meet both current and future financial obligations and is an important component of any finance application. That’s why is forms part of the agenda of in our monthly board of advice – just one part of our business consulting services.

An accurate and current balance sheet is an important financial tool, to tell you how many assets the business has, what debts it has and what equity (savings) it has created for shareholders. It tells us where the business has spent the profits, or how the losses have been funded. A balance sheet is a window into what is going on in a business.

Balance sheets are pretty easy concept to grasp. The accounting definition is;

Assets = Liabilities + Equity,

If we do a little re-arranging you’ll get;

Assets – Liabilities = Equity

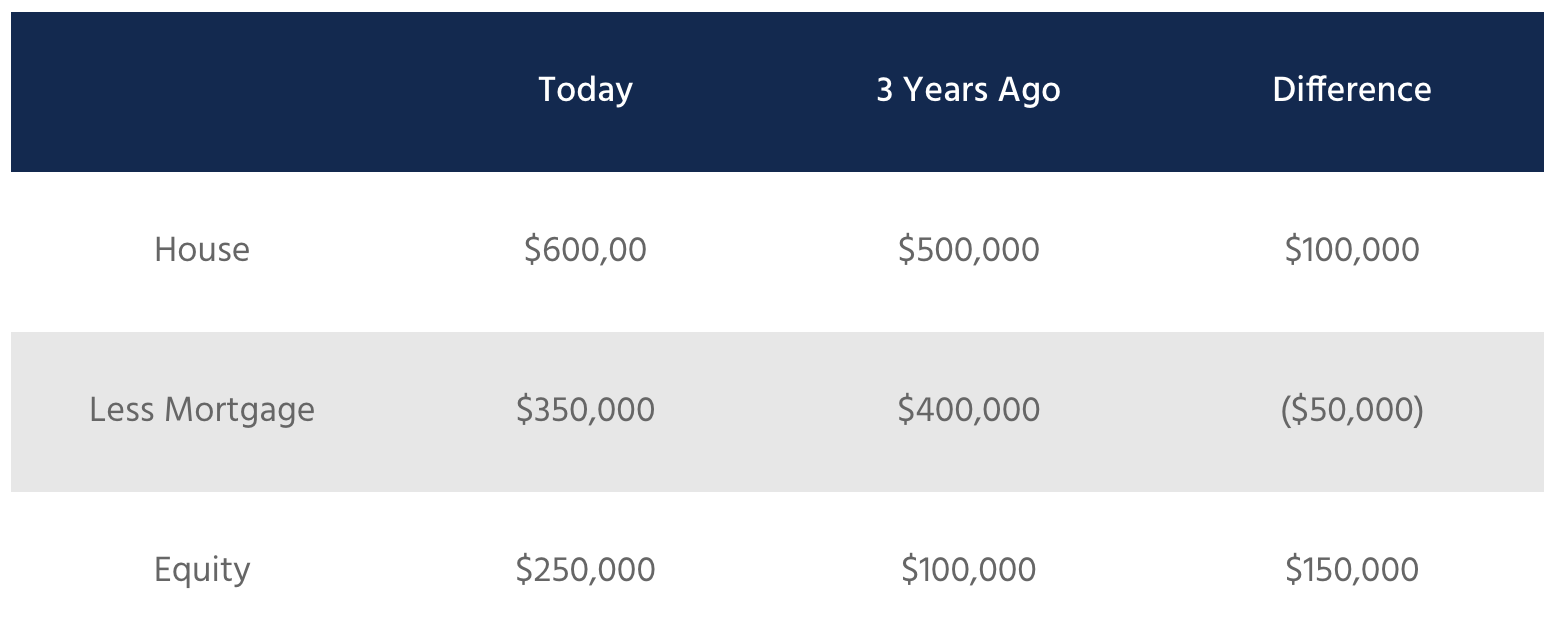

Think about your house. You bought it $500,000, you used savings of $100,000 and a loan from the bank of $400,000.

3 years later that house is worth $600,000 and you’ve paid $50,000 of the loan. Your balance sheet would look like;

So, in order to utilize a balance sheet, you must first understand these three primary components.

Assets:

Assets are defined as things that will provide a future economic benefit. Common assets include cash in the bank, the amount customers owe you (accounts receivable/trade debtors), stock on your shelves, plant and equipment, and real estate and intangible items such intellectual property like, patents, and copyrights. The types of assets a company has reveals a lot about its financial health. It might be asset rich and cash poor, it could be holding too much stock, or customers aren’t paying.

Equity:

The equity of a business is calculated by subtracting the sum total of liabilities from its assets. The equity may consist of owner equity or shareholder equity, depending on the business structure. This the net “savings”. Over the entire course of the business what has it managed to save, and not yet paid out to shareholders.

Liabilities:

These comprise things like how much you owe suppliers (accounts payable/trade creditors) wages, superannuation, income tax, GST, PAYG Withholding, credit cards and loans from banks or shareholders.

While these are the key elements of a balance sheet, it’s important to note that the type of business is another important consideration. Overall, the higher equity value of a company, the less likely it is to encounter monetary difficulties.

As a small business owner, you are likely accustomed to wearing multiple hats to save money. However, the accounting aspects can sometimes be intimidating. Bottom line, when it comes to the financial security of your business, resist the temptation to be cheap.

Small businesses often fail due to lack of proper accounting knowledge and poor cash flow. So avoid becoming a statistic with the right tools and understanding.

Following is an in-depth explanation and examples of what is included on a small business balance sheet.

Current Assets

Small business assets are categorized based on the ability to convert them to cash. For instance, the short-term asset category includes anything that can be sold or assigned a cash value within a 12-month period.

Examples include:

- Trade Accounts Receivable

- Cash

- Stock

- Prepaid Insurance

Non-Current Assets

Next is the long-term assets category. This group of items will include physical and non-physical items that are intended to help you conduct business, as well as improve business value over an extended period of time. Within the long-term assets category, you may have sub-categories such as fixed assets, intangible assets, and investments.

Examples Include:

- Company Vehicles

- Machinery

- Structural Property and Land

- Furnishings

- Equipment

- Franchise Rights

- Copyrights

- Patents

- Trademarks

You May Also Like

Current Liabilities

Short-term, or current liabilities are financial obligations that will be paid for within 12 months. These things include everything from taxes and employee wages, to products and services required to run your business.

Examples include:

- Accrued Expenses – All businesses have overhead that consists of payroll, sales and employer taxes, and interest. Accrued expenses are generally paid out weekly, monthly, or quarterly. For example, employees work and earn an income, then paid after the fact.

- Customer Deposits – Funds that are paid by customers as a deposit on goods or services, which will eventually be applied towards their purchase.

- Dividends Payable – This applies if you have shareholders, whereas a percentage of business profit is paid to those individuals.

- Trade Accounts Payable – This short-term liability includes expenses your business has incurred in order to obtain products or services from vendors or suppliers.

- Tax Office Liabilities – GST, PAYG Withholding, PAYG Instalments, Income Tax, Fringe Benefits Tax

- Superannuation

Non-Current Liabilities

This category includes liabilities that will not be paid off within one year.

Examples include:

- Long-term Loans – Mortgage, vehicle loans

Equity

- Issued Capital – The amount the shares or units were issued at. These are usually $1 shares, but can be different. The important thing here is this isn’t the number of shares issued, it’s the value at which they were issued. If you’re a sole trader, this is how much did you contribute to start the business.

- Retained Earnings – how much profit or loss has the business produced from when it started up to the start of the current period but not yet paid to shareholders as dividends.

- Current Earnings – this is the profit or loss for the current period that you are running the report. This amount will match the profit or loss from your profit and loss statement

Business success relies on precise financial documentation and as I said the balance sheet works in conjunction with the profit and loss statement. The profit and loss tells us how much profit or loss was made in a period. The balance sheet tells us where you spent that profit or funded the loss.

Both of these reports are vital accounting tools used to determine how successful a business is. While the P&L is sexy and gets all the glory, the balance sheet is the boring but extremely practical friend.

Every business owner wants to be successful and enjoy a prosperous future. With the forecast balance sheet, you will be able to predict the financial health of your business.

It’s part of a “3-way budget”. A forecast cash flow statement, profit and loss statement and balance sheet are used to forecast the future health of a business, where it might need cash flow support from a bank and what the business will look like in the future.

Regardless of the type of small business you have, the balance sheet is an integral part of business success. By understanding your balance sheet you can identify future cash flow obligations and issues, and whether you’re business is growing in value.

If you need help understanding how to use your balance sheet our business consulting services can be tailored to meet your needs so contact us today.