You know how it goes, you hire a new employee, send them the super choice form and they leave it blank or don’t return it, so you’re required to set up and contribute to your “default super fund”.

But from 1 November 2021 this is changing as part of the Your Future, Your Super legislation. Huzzah!

Related Content

The Your Future, Your Super, was announced as part of the 2021 Federal Budget and contains for key elements;

- A new YourSuper comparison tool – for individuals to compare key data on MySuper Products (i.e Hot or Not)

- Stapled Superannuation Funds

- Trustees now to act in the best interest of their members (umm – how was this not a thing already??)

- A new super fund under-performance assessment to be conducted by APRA>

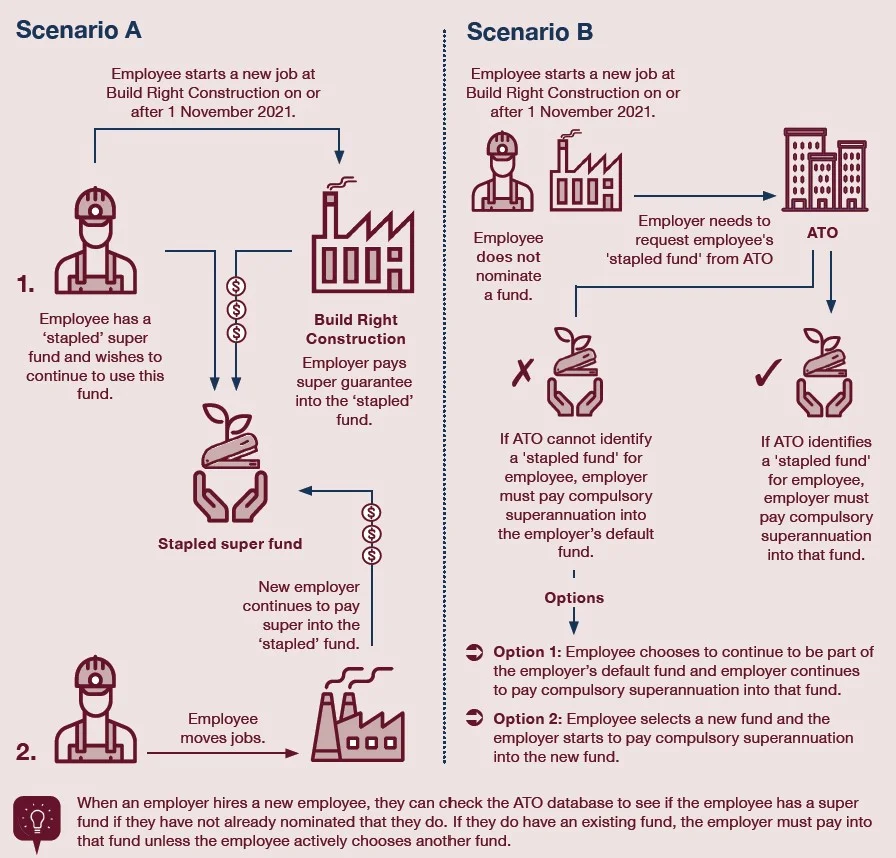

From 1 November 2021, employees starting a new job will have the super fund used at their former employer “Stapled” to them i.e it will follow them around to their next employer.

This is aimed at preventing employees ending up with 10 different super funds all with 2-3 years worth of contributions charging fees and insurance premiums and eating away at any hopes of retirement.

So unless the employee actively chooses to change super funds, the fund they currently have will be the one that follows them as they progress through different employers. This makes it really important that you check your super fund performance and avoid picking a dud – otherwise you could be “stapled” to this loser for your whole life. I guess that is where the under performance assessment and the MySuper comparison part of this legislation comes in to help people make an informed decision about which fund to contribute their hard earned to.

You Might Also Like

So what does an employer need to do? Well you still need to give your employee a Super Choice form as part of their onboarding.

If the employee doesn’t nominate a fund, you need to request the employee’s “stapled fund” from the ATO. If the ATO can’t located a “stapled fund” you set up and contribute to your default fund as you would now. Alterntivley, upon you informing your new asset that you’ll be contributing to the default fund for them, they can choose to open a new fund and then you contribute to that one.

If the ATO does identify a “stapled fund” you must pay to that fund.

If the employee doesn’t nominate a fund, you’ll need to search with the ATO for a “stapled” fund. To do this you need to have ATO Online Services set up.

Alternatively, you can have your tax agent search for you (and pay for their time).

You’ll need your employees TFN, full name and date of birth (and address if no TFN is given)

The ATO will then do a search and notify you on screen of the fund (this will take a few minutes). The ATO will also notify the employee that you’ve done a search and the fund they have found for them.

If you’re hiring bulk new employees the ATO will have a bulk request form available to do more than 100 employees in one go.

Of course, there are penalties for non-compliance for employers – so just update the onboarding process and get the search done.

Stapled Super is real, and unfortunately it’s going to take employers a bit more time in the onboarding process, but the pay off is hopefully, you don’t have to contribute to a default fund, and your new shiny employee will have only one fund to help them save for retirement.

Need help with your accounting and tax obligations? Contact us.