A family trust is an agreement where the trustee (either a person or company) holds assets for the benefit of others – like family members.

There’s lots of names thrown around; family trust, trust fund, discretionary trust and lots of confusion about how trusts work so if want to understand what they are, and how they work then you’ve come to the right place. Strap yourself in, and trust me….

Imagine this. It’s 1813, you’re Natalie Portman Keira Knightley, you’ve got 4 sisters and no brothers. Your dad Donald Sutherland, an aging middle-class man has a double block with a bit of a fixer upper on it.

The current law says women can’t own property (or do pretty much anything), so when he dies your mum, you or any of your sisters can’t inherit the house.

So instead of you all having to try and get a rental as a NINJA (no income, no job, no assets), your dad makes an agreement with his cousin that goes like this;

Dad: Hey Cuz, when I die, you’ll get the house cause you’re the next in line male relative

Cuz: (feigns surprise) oh really? Of course, I’ll take care of it (and sell it to the developers)

Dad: But of course, my wife and daughters need some digs to live in until they marry or pop their clogs

Cuz: yeah, what’s your point. You want us to get married?

Dad: What?

Cuz: What?

Dad: I want you to let them live in the house until they either marry or pass away.

Cuz: Right…..ok, Cuz, I’ll look after the place for you and let them live here. I mean property is only going up, and I’ve got a patron who’s letting me stay in her guesthouse. But of course, all the expenses of your property need to be paid for and I’m just a poor clergyman

Dad: yeah no wuckers. They’ll be some bags of cash under the back stairs for that sort of stuff

Cuz:..and if someone falls through that dodgy extension you did out the back and sues, I want the estate to cover those costs too.

Dad: makes sense. Deal?

Cuz: Deal. Tell me, does Keira like portly clergymen?

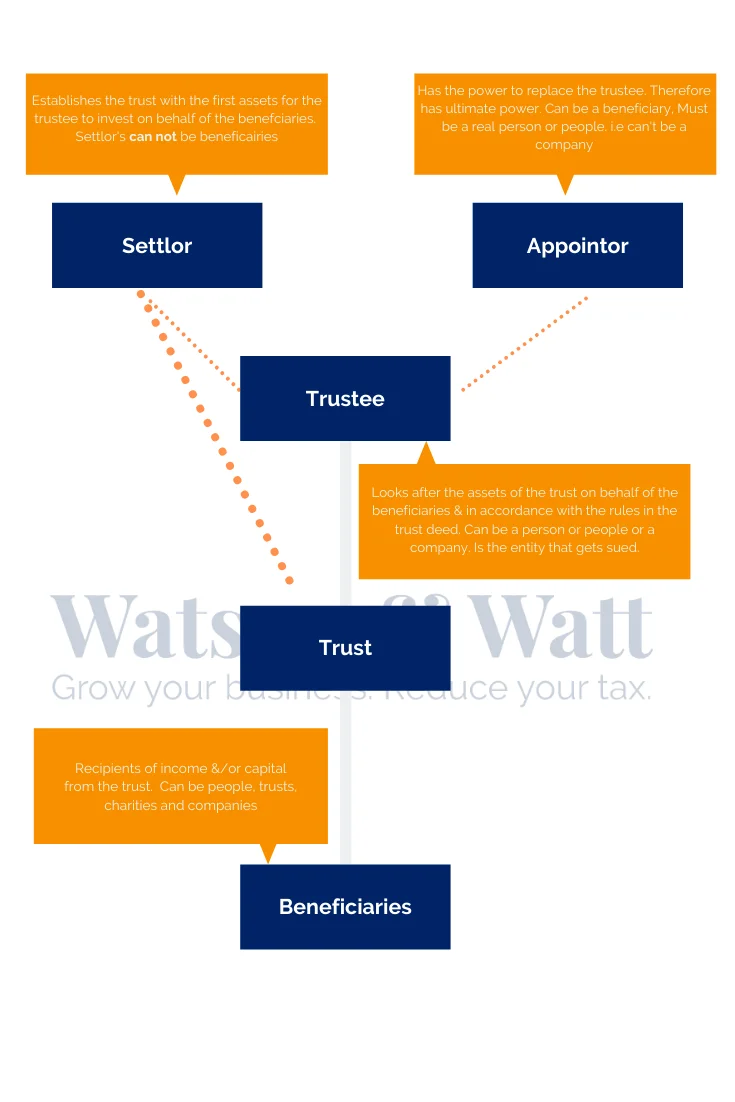

Your father has just created a “trust”. He has given assets to someone for them to look after those assets on behalf other people. Here check it out in visual form;

Your father has just created a “trust”. He has given assets to someone for them to look after those assets on behalf other people. Here check it out in visual form;

There are a few different types of trusts, they’re still all cups of tea, but some have a twist of lemon;

Discretionary Trust (aka family trust)

Generally, when people refer to family trust what they mean is discretionary trust. So what are Family trusts? They are a technical tax term that you really don’t want to read about unless you suffer from insomnia. To make a family trust under the tax law you need a family trust election but let’s save that conversation for another day.

A discretionary trust gives the trustee discretion over which beneficiaries (if any) will receive a distribution of income or capital, and how much that distribution is, in any given year. This discretion makes them highly flexible to manage (aka minimise) group taxation.

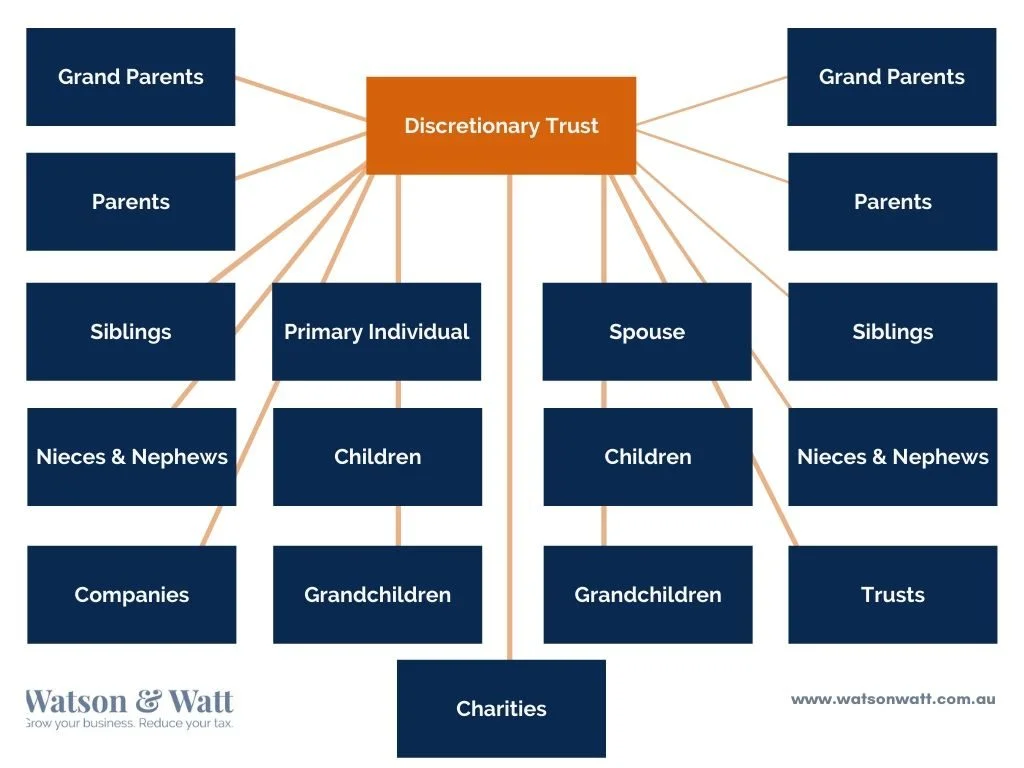

The beneficiaries in a discretionary trust are usually (though don’t need to be) very broad. To do this, they use “classes” of beneficiaries so they don’t need to name every single person (or company, other trust, charity etc) that can get a distribution, and those people or entities, don’t even need to exist at the time when the trust is created.

Typical Classes of Beneficiaries

- Primary Beneficiary – this is the main dude or dudette

- Spouse of Primary Beneficiary (so if you’re single, then get married you can distribute to your spouse, even though you didn’t know who they were when you set up the trust)

- Kids, siblings, parents, grandparents, grandchildren of primary beneficiary (so even though you’re 25 and don’t have grandkids (hopefully) when the trust was set up, they are still eligible to get a distribution once they’re born)

- Kids, siblings, parents, grandparents, grandchildren of the spouse of the primary beneficiary

- Kids of the primary beneficiaries’ siblings

- Kids of spouse’s siblings

- A company in which any of the above own a share in

- A trust in which any of the above are a beneficiary of

- Any registered charity

- Any registered religious organisation

Phew. This picture probably makes all that clearer

Unit trust

Unlike a discretionary trust or family trust, where the beneficiaries are a class of people (like your siblings, parents, grandchildren) the beneficiaries in a unit trust own a share (called a unit) in the trust. Like owning a share in a company. This locks their entitlement of the income and capital to the percent of the trust they own. The trustee doesn’t have any wriggle room.

These are good when you want to invest with people outside your family. Say your business partner, or that guy you met who has this hot tip.

So why use a unit trust instead of a company? Good question.

Because trusts can access the 50% Capital Gains Tax discount for assets held for more than 12 months and pass this onto the beneficiaries.

Companies cannot get the 50% discount. This makes unit trusts very popular to buy passive assets like property. In fact every time you hear the term property trust, it’s most likely a unit trust.

Hybrid Trust

These try to be the best of both worlds. A unit in the capital of the trust, and discretion on the income side. The tax office, REALLY doesn’t like these, and quite frankly neither do I.

Fixed Trust

You’ll hear this thrown around a bit too. Again, this is a technical tax term, but people use it when they mean unit trust.

Yes, but within limits. All trust’s have an expiry date, commonly called a vesting date. This is long established in the case law. Because trusts became mainstream in Ye Olde England, the vesting dates use to be set on the date of death of the last lineal descendant of some king or queen I can’t remember the name of. And some of the old trusts/deeds are still based on this. But these days if you set up a trust, its lifespan is 80 years. You can kill it off before then, but you can’t extend it beyond that. Why? Good question. I dunno.

So if a trust can distribute to another trust, can’t we get around this 80 year rule? Yes, but no. The ATO doesn’t like it, but they’ve also said they’re not going to throw resources at it to chase it down.

No but yes. If the trustee doesn’t do their job properly or if they actively choose not to distribute the income for the year to anyone (because all the beneficiaries are entitled little trust funds babies suckling on the teet of granddaddy’s hard work), the trustee will pay the tax on the income in that year. It can get a bit complicated, but in general the tax rate is 47%. Ouch.

If the trustee does distribute the income to the beneficiaries, the trust doesn’t pay any tax. It can also pass on things like capital gains tax discounts and franking credits with the distribution. So the beneficiaries enter this income into their tax return along with any capital gains discounts &/or franking credits.

No, but yes (eventually). The trustee doesn’t have to pay the distribution in cash. It can make a handshake deal with the beneficiary to distribute to them for tax purposes but reinvest the cash into the trust’s investments or other activities. This creates a loan from the beneficiary to the trust. That beneficiary is legally entitled to those funds and can ask for (and is entitled to) them to be repaid.

So there’s a few different types of trusts. In Australia, family trusts are the most common, because you’re most likely to invest for/with just your family than you are with a mate.

As a shareholder in the family company that runs a business

I love this structure. It’s my go to for those running a business which I’ve written about before. The company pays dividends to the trust but only when the directors choose. Ideally when company has the cash, and doesn’t have a use for it in the business (but there are other reasons they need to declare a dividend. The trustee then distributes this to the family trust beneficiaries before 30 June each year.

As the owner of business premises

Owing real estate and the premises the family business operates out of is a common goal in Australia.

The business wants certainty of tenancy, and people generally like real estate as an asset. It’s a way to diversify the family wealth away from just the business value. A family trust can buy the business property and rent it to the trading company. This is the same family trust that owns the shares in the company that runs the business.

If the property is negatively geared, we can use a great tax minimisation strategy in Australia by then declaring fully franked dividends out of the trading company to the family trust and use these losses.

It results in something we in the trade call “super franked income”. Which is basically getting a cash refund of the tax the trading company has paid. Let’s take a look at how this works;

Dividend From Trading Co $24,000

Franking Credits $9,103

Taxable Dividend $33,103

Less Loss on Commercial Property $33,000

Distributable Income $103

The beneficiary receives $103 of income to put in their tax return, but it comes with $9,103 of tax credits that can be refunded. #winning

As the owner of residential investments

Same situation as above, except the trust owns a residential property and rents it out. This can also result in super franked income. In some situations the family home can be purchased in the trust and rented back to you. But there are some major tax implications for this and the numbers need to be crunched pretty hard before you’d go down this path. For asset protection though this can be a great solution for those with a lot of personal risk such as auditors, directors of companies – listed and unlisted, liquidators, and doctors.

As the owner of listed shares & managed funds

Investing in shares and managed funds through a trust is pretty handy too. As I mentioned before trusts can pass on franking credits and capital gains tax discounts to beneficiaries. They can also distribute to charities and other companies.

So depending on your circumstances, whether you are drawing the cash from the investment income out of the trust, and your personal tax rates, you can defer a heap of tax, 19.5% to be exact by distributing to a family company. There are some wrinkles in this strategy, but if you’re diligent, it can result in accelerated growth of your investments because you’re reinvesting up to 19.5% of your investment income back into investment assets. Over a couple of years this can make an extraordinary difference in your wealth accumulation.

By now you should have a good understanding of what a family trust is and how they work. To recap they are a legal structure dating back hundreds of years and are a great structure to create a “hub” of the family wealth.

It can own property, listed and unlisted shares, cash, gold or any investment asset (it’s only limited by what the deed says). It can also own and run businesses (though I don’t rate this much).

All of the investment income comes into this one trust, and the trustee then decides which family members (or family company) is best to distribute to, taking into account the tax implications this will have all while providing a degree of protection for the assets you’ve accumulated. Anybody serious about building wealth and limiting their asset exposure is highly recommend considering how this structure can help them achieve their goals.

Yeah cuz. As part of our accounting and tax services.