Business is all about leverage. Leveraging other people’s (employees) time, leveraging other people’s (investors, banks) money, leveraging systems and processes and leveraging assets (property, machines, software etc).

And of course hand in hand with leverage is risk. But also reward.

Think of property. You can buy a house with 10% deposit (in some cases 5%), that means you can control an asset worth 10x your investment. Your return on investment is then leveraged (amplified) by a factor of 10.

For example, invest $100,000 and buy a property worth $1,000,000. The property value goes up 10% to $1.1 million. You’ve just made $100k and doubled your invested money (100% return). Sell it all up and you’ve got $200k (ignoring taxes & transactions costs for a sec).

That’s the power of leverage.

Conversely, it works the same way on the way down. You buy the property, it goes down 10%, you’ve lost 100% of your invested capital.

This is the risk of leverage. Both wins and losses are magnified.

And the same logic goes for all parts of your business. You employ someone for $50 an hour. You charge them out to clients at $400 per hour. That’s 8x leverage. Every hour they’re doing billable work you win, and offsets the hours that can’t be charged (annual leave, sick leave, toilet breaks, “admin time” etc).

Every hour you don’t have work for them to do you’re losing a hard cost of $50 per hour (and an opportunity cost/soft cost of $400 per hour).

You buy bread rolls for $1 each, serve it with butter on a side plate. 8 bucks thanks (8x leverage).

Every business is based on leverage.

If you can’t leverage things you are not business. You’re self employed.

Success in business depends on how good you are at leveraging things.

And small and medium business generally isn’t about market domination. It’s about taking a small piece (margin) of the already existing pie and making it yours. Taking a sliver of pie from each of the other many market participants. All these small slivers you take, can add up to a whole piece (and then some).

Each of the existing competitors barely notice you’re there. You might win a client or two from them. No biggie. But take a client or two from a hundred different competitors and you’ve got yourself a business. Small pieces add up real quick.

Related Content

And the same goes with the leverage in your business. Small changes to your margins make significant differences in your net profit and business value thanks to leverage.

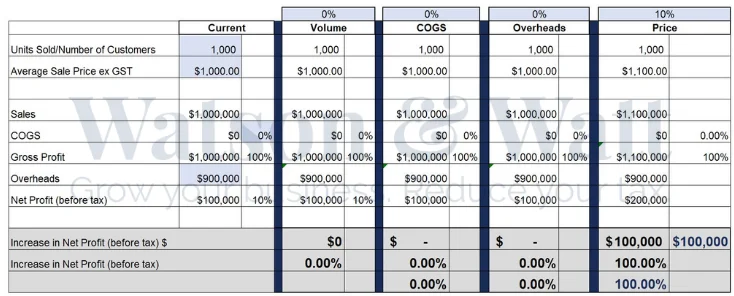

If you do $1,000,000 in revenue and you make 10% net profit before tax. That’s $100k.

Increase your price by 10% (and assuming no decrease in volume sold), you’ve just added another $100,000 to your net profit before tax.

To put that 10% price increase into real terms, that’s increasing the price of something from $1 to $1.10, $10 to $11. It’s not a lot in real dollar terms in most cases.

And in the example above, a $100,000 profit increase on a $100k profit is a 100% increase in profit.

But more importantly it’s ONE HUNDRED THOUSAND DOLLARS. There’s the school fees paid each year. There’s a big chunk for the deposit for your kids first house. Do that for the next 10 years and retire 10 years earlier.

Think about how long it took you to climb the career ladder to your first 6 figure job, or the first business that made $100k profit. How hard did you work?

And now you’ve done it with just a stroke of the pen on your price list.

But it’s not just the annual profit that also gets a bump, the more profit you make, the more your business can sell for. If for example it can get a 3 x profit sale value, and you add another $100,000 to your profit, you’ve just added $300,000 more to the sale value. Holy leverage Batman. I’ll take 4 please.

That’s leverage. That is the power of your margins.

Of course you can’t just keep jacking up your prices to get profit growth. But it illustrates how leverage in your business works. How relatively small changes in the margins can make material differences in your life.

So other than price what drivers are in your business?

- Volume

- Direct costs

- Overheads

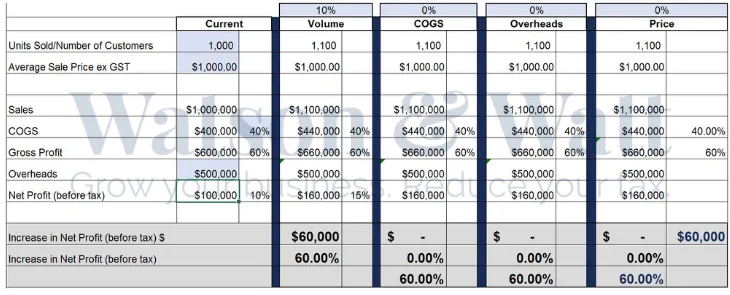

Again, think of increasing the number (volume) of customers you have by 10%. What does that do to your net profit margin (hint, multiply your gross profit by 10%)?

I get it, you may not have much purchasing power with your suppliers, but look for areas where you can save. Using air freight instead of sea? I bet there’s a few grand in there.

There won’t be savings everywhere, but there’s usually a few grand to be found.

So set yourself the challenge. Find 1% of cost savings in your business.

If you have $900,000 in expenses, 1% is $9,000. There’s your accounting fees paid (ha!) or a week or two at the beach. All hidden in your margins. That $9k goes straight to your net profit, so on that $100k profit that’s $9k/$100k = 9% increase in net profit. Hello leverage.

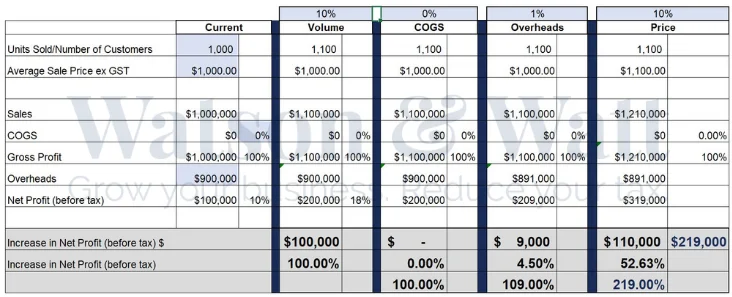

As you can see there’s only 4 drivers to business performance; price, volume, direct costs, overheads. And even just changing one of these can have massive impacts to your bottom line (and real world life). But the best thing is that they are not mutually exclusive. You can mix and match changes in drivers to suit your strategy. Let’s for shits and giggles assume you’ve got a killer sales system at the moment, for whatever reason its working. You’re charging higher (10%) sales prices, and getting more customers (10%). And you’ve managed to find 1% of expenses you can do without. Take a look at this.

Your net profit is now $319,000. That’s $219,000 more each year than you started. WOW.

Send the kids to Harvard, set up a scholarship for deserving kids, donate to your favourite charity. Give us a tip.

Now the numbers above only apply to that specific financial profile, so you need to crunch the numbers on your business (or, shameless plug, get us to help with our business consulting service).

Now I understand you’re not all money driven. You’ve got a bigger “why” than just money. I get it, but with no margin, there’s no mission.

Steve Irwin said it best.

“Money’s great….I can’t get enough of it and you know what I’m going to do with it….. “

So yes you might have a higher calling than money. You have passion and drive and want to change things – that’s great. But I suspect having a bunch more money behind you would help right?

And even if you don’t have a benevolent calling, maybe you just want to make a bit more for you family, look to your margins, because that’s where the money is.

Need help? Well that’s what we do. Get some here.