Back in the day, commercial property loans were pretty standard; 30% deposit and 10-15 year term.

Obviously 30% deposit makes it difficult for most when it comes to funding position, then add in the short loan term and bye-bye cash flow. So the good news is that it’s (at time of writing) 2021 and things have changed.

Some major lenders will now go to 100% LVR with a 30 year loan term on an owner occupied (commercial) property. Of course, they get you by the short and curlies by taking security over your house, and personal guarantees for any other assets you may have – but it’s possible.

Related Content

And that might be a great option where you don’t have hundreds of thousands sitting in your dollarmite account earning 0.0001% interest to use as a deposit, but the equity in your home is more than enough and buying your own premises is actually cheaper than renting.

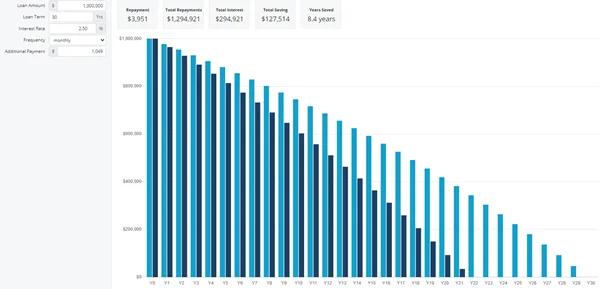

If you’re paying rent of $60,000 p.a at the moment, you could fund a $1,000,000 property at 2.5% interest, with 100% Loan to Value Ratio and have that loan paid off in 21 years! Crazy.

Even if the property doesn’t go up in value, and you sell if for what you paid for it. The rent you would have paid, has paid off the debt and you’ve got a $1 million asset (so essentially it’s cost you no more than you would have paid in rent to someone else). To me that’s a really compelling argument for buying your own place. Of course there are other things to consider before you buy your own premises, but from a financial perspective it can make a lot of sense.

If the property was inherently connected with the running of your small business and you satisfy the other eligibility criteria of the small business Capital Gains Tax concessions – you may pay as little as ZERO TAX** when you sell the property. (**so many criteria to satisfy. So many).

Now if you don’t want to use the house as security (and the first scenario is always – what can we do without giving up main residence security?). The same lender will also, if the debt is less than $1 million lend you up to 80% on just a few documents;

- A statement of position

- BAS (no older than 4 months)

- ATO Statement

You’ll need to have a pretty straightforward corporate structure (if you have a trust you’re out), and no debts with the ATO, but other than a few other basic eligibility criteria, security over the property and a personal guarantee – you’re in with a shot.

I don’t know about you, but I think that’s amazing.

This isn’t a back-alley lender with interest rates that make your eyes water and a debt collection team that have a fine collection of baseball bats. This is a big 4 bank.

You May Also Like

I guess the point of this article, is to bust the myth that owning your own business premises is only for the well-heeled.

These days it’s a real possibility for many business owners, and can make more sense than renting. Of course there are risks – there always are – even with signing a lease agreement. But if owning your own place is one of your goals, weigh up the risks and contact us to have a chat about getting it funded.